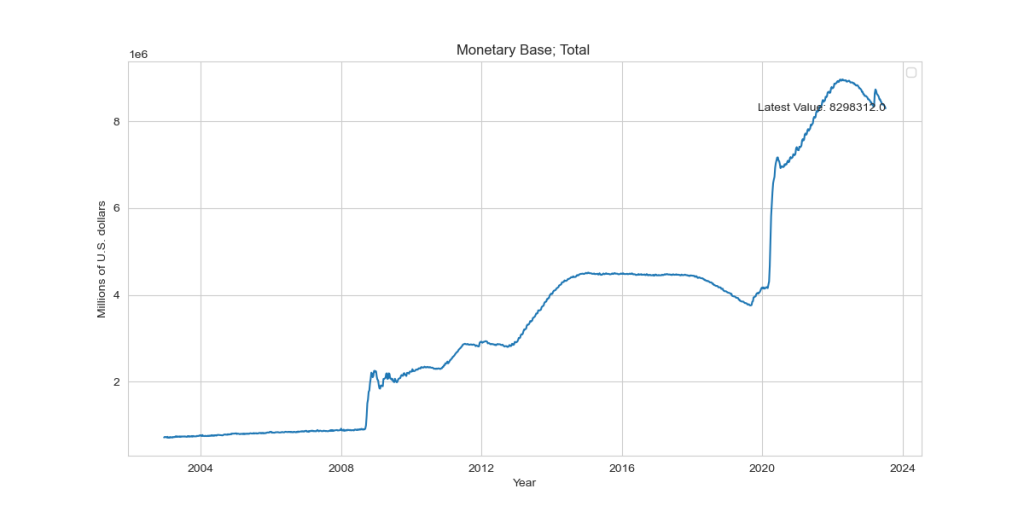

The following charts present data on M2 and the corresponding percentage changes from the previous year. The first chart highlights that M2 experienced a significant 25% increase during the pandemic period. However, it has since started to decline, currently showing a decrease of -4.63% compared to the previous year.

M2 refers to a widely-used economic indicator that measures the money supply within an economy. It represents a broader definition of money compared to the narrower monetary base. M2 includes not only physical currency and coins in circulation but also various types of deposits held by individuals, businesses, and other non-bank entities.

The components of M2 typically include:

- Currency in circulation: This represents physical money, such as coins and banknotes, that is in the hands of the public.

- Demand deposits: These are funds held in checking accounts, which can be easily accessed and used for transactions.

- Savings deposits: These include savings accounts and money market accounts, where individuals and businesses can hold their money and earn interest.

- Time deposits: These are fixed-term deposits, such as certificates of deposit (CDs), where the funds are held for a specified period, typically with higher interest rates than savings accounts.

- Retail money market funds: These are mutual funds that invest in short-term debt securities and provide individuals with an option to invest their money in relatively safe and liquid instruments.

M2 is considered an important measure of the overall money supply and is closely monitored by economists, policymakers, and investors. Changes in M2 can provide insights into the level of liquidity in the economy and the potential for inflationary pressures.

During periods of economic growth, M2 tends to increase as individuals and businesses have higher demand for money to support their transactions and investment activities. Conversely, during economic downturns, M2 growth may slow down or even contract as individuals and businesses reduce their spending and increase their savings.

It is worth noting that M2 growth can also be influenced by monetary policy actions undertaken by central banks. For example, when a central bank engages in expansionary monetary policy, such as lowering interest rates or engaging in quantitative easing, it can lead to an increase in the money supply and contribute to M2 growth.

Overall, M2 provides a comprehensive view of the money supply in an economy, encompassing various forms of money and deposits. By tracking changes in M2, economists and policymakers can gain insights into the state of the economy and make informed decisions regarding monetary policy and financial stability.